Search Results for: financial plan

How Modern Moms are Taking the Lead in Financial Planning

Many of us grew up in a household where Dad was the breadwinner and Mom was a homemaker. Such was our social culture at the time. Men controlled all the money and gave a household allowance to their wives. But that meant that women had the real power when it came to purchasing decisions.

The 6 Financial Habits Of Mentally Strong People for Year-End Planning

As the seasons start to change and the holiday season approaches, it’s the perfect time for a financial check-up. Let’s reflect on how much we’ve accomplished this year and set the stage for financial success in the upcoming year with some year-end planning. If you haven’t scheduled a meeting with your advisors yet, now is the time to get your financial planning done. In fact, for our clients, this is one of the busiest and most important planning periods of the year.

Many of us set ambitious financial goals, but how often do we follow through with them? It’s time to take a page from the mentally strong and map out some to-dos to achieve our financial objectives as we head into the end of the year. Remember how important reaching financial independence is?

How to Handle Your Finances in a Divorce: A Financial Advisor’s Guide

Divorce is one of those uncomfortable words that, when entering a blissful marriage, we hope never applies to us. But you and I both know that, unfortunately, divorce happens—a lot. It can be one of the most emotionally and financially challenging experiences in life.

Holiday Budgeting Tips: How Moms Can Prepare Financially for the Season

The holidays can be a magical time filled with family, fun, and festivities, but they can also create financial stress. Between gifts, travel, and gatherings, the holiday season can strain even the most well-planned budget. To help you stay on track, here are 10 practical holiday budgeting tips that will allow you to enjoy the season without the financial hangover. Plus, we’ve included some great tools and affiliate resources to help manage your spending!

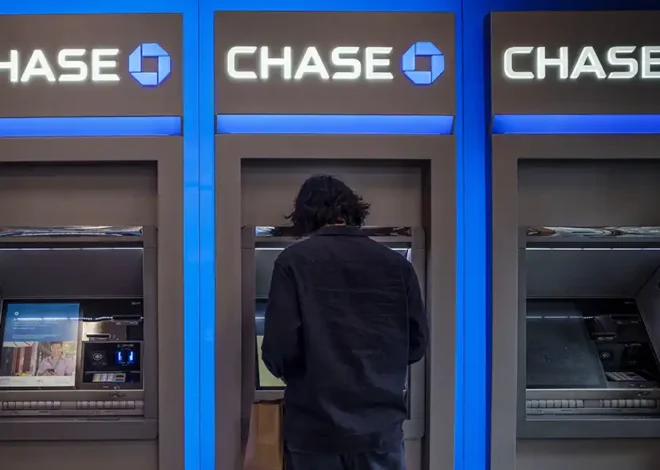

Why You Should Absolutely Avoid the “Bank Glitch” Trend: Protect Your Financial Future

As a mom of three and a financial advisor, I’ve seen firsthand how essential it is to teach kids about budgeting, saving, and financial responsibility. Equally important is educating them on what not to do, and here’s a prime example: a dangerous trend is circulating on social media, encouraging people to exploit a supposed “bank glitch” to withdraw free cash from ATMs. While this may seem harmless in viral videos, it is actually bank fraud and can lead to serious legal trouble for you or your kids.